Responsive Web

BNZ Biometrics Sign up

01.-

Context

Background

Bank of New Zealand is one of New Zealand's big four banks and has been operating in the country since the first office was opened in Auckland in October 1861 followed shortly after by the first branch in Dunedin in December 1861.

02.-

Objectives

Business Opportunity

Goals for sign up experience

• Understand the behaviour of customers and where they are most likely to fall through in the sign-up process. The output of the interviews enabled us to document the current on-boarding journey, provide gap analysis again the existing process and identify pain points for staff and customers during this experience.

• Conduct an experience analysis to understand where Employee Banking (EB) Advisors deviate from the current process. Where do they perform workarounds, no deviation to the process, stop a process, involve others, show any emotional engagement in the process?

• Understand the roles/responsibilities of EB Advisors, Store Managers and EB Partners and how they form the whole customer experience.

03.-

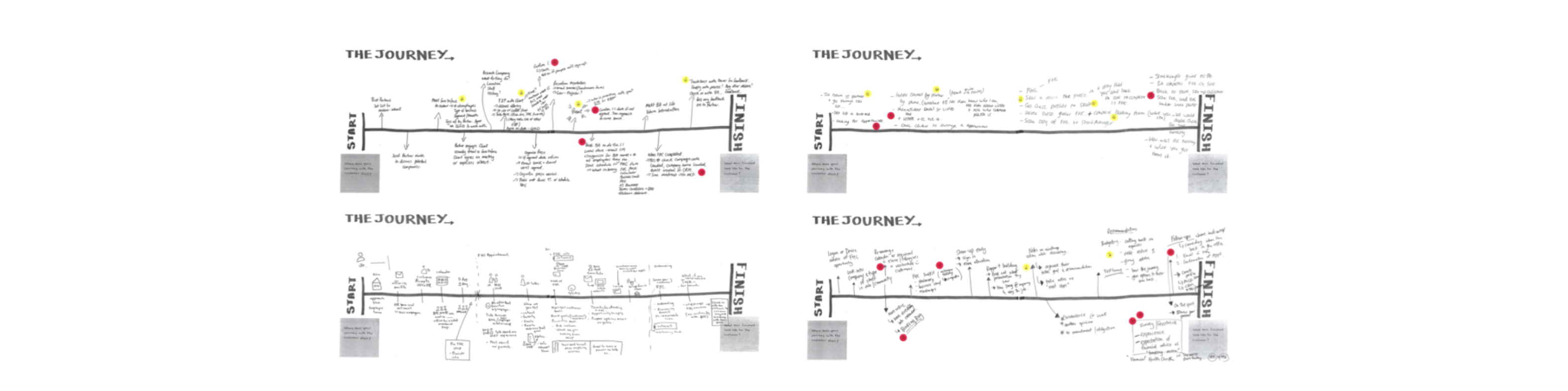

Research

Discover

I was involved in the discovery phase for customer on-boarding process within Employee Banking. 12 interviews were held with store staff to identify the current process for on-boarding customers via Employee Banking.

12 interviews were held with:

• 9 Bank Advisors

• 3 Employee Banking Partners

• Locations across 3 Auckland, NZ stores

04.-

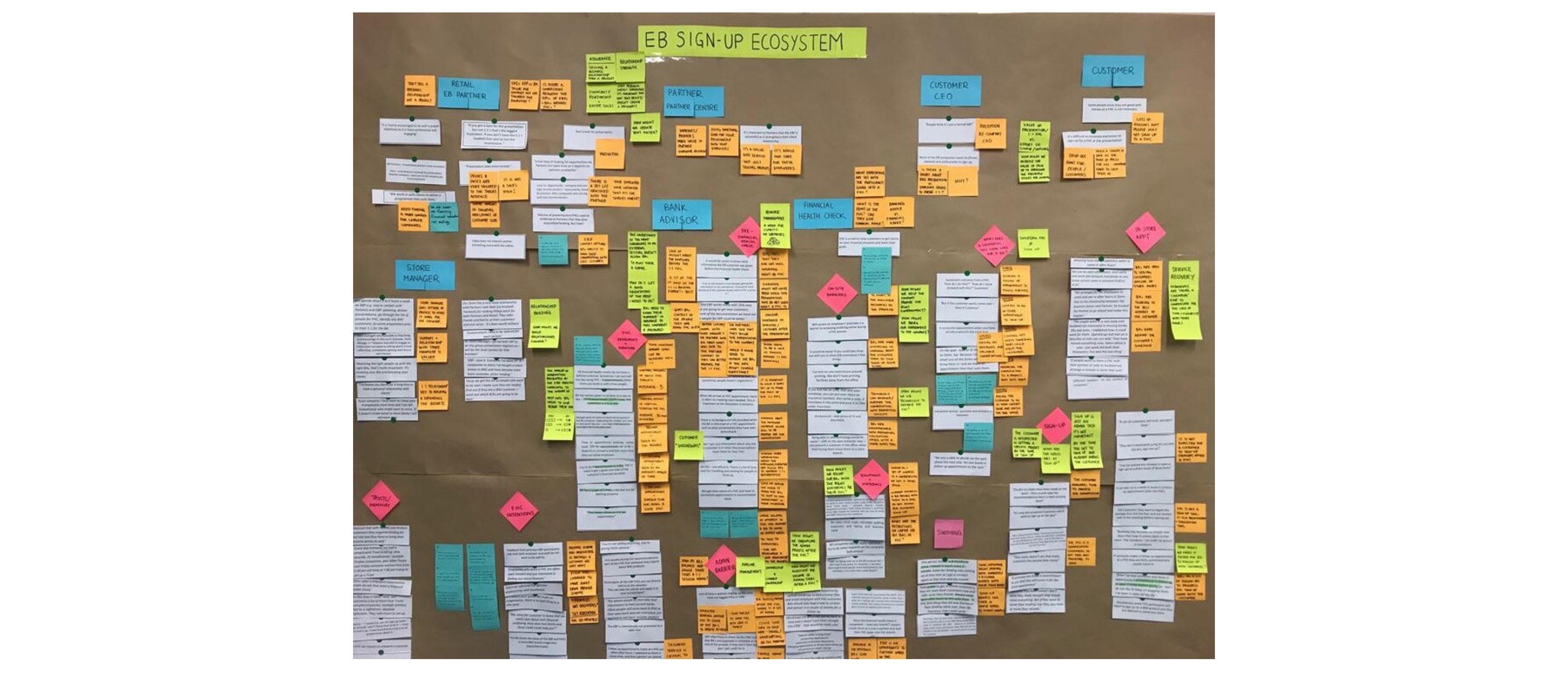

Our Ecosystem

Employee Banking Ecosystem

The ecosystem diagram shows the different entities and the relationships we focused on in the interviews. When we framed our questions, we kept in mind the working dynamics between the different teams/entities and how they inform each other. We had questions that focus on the specific aspects of sign-up (between the EB Advisors and Customer) as well as the BAs experience with other teams that indirectly relate to the sign-up experience.

05.-

Insights & Opportunities

Key Insights

• Too many unknowns in an external setting doesn’t allow Bank Advisors to play their A game. Bank Advisors need to know their ‘audience’ in advance to feel confident and prepared.

• There are time constraints around what can be achieved in a 1:1 Financial Health Check. 30min is not enough time. 45min is an adequate amount of time. 60min is an ideal engagement time.

• Service recovery: individuals are taking a ‘champion’ role to compensate for the lack of time/flexibility with store hours.

• It is timely for a BA to load Financial Health Checks into the CRM. There is variance in the feedback Bank Advisors give Employee Business Partners.n

• Resources on site do not allow the Bank Advisor to proceed further in the FHC i.e. cannot print off material, cannot not access the internet to make a follow up booking.

• Sign up process can take a couple of weeks to 12 months. Banking Advisors ensure customers are not disadvantaged by switching. They make sure it is the right time for customers to start the process i.e. at the end of a loan or term deposit.

Opportunities

• How might we help the company provide the right environment and tools to conduct Financial Health Checks?

• How might Banking Advisors get a quick orientation of the preparation they need to do before an appointment?

• How might we alleviate/streamline the volume of admin tasks after conducting a Financial Health Check?

• How might we increase the value of sign up to overcome perceived effort for joining?

06.-

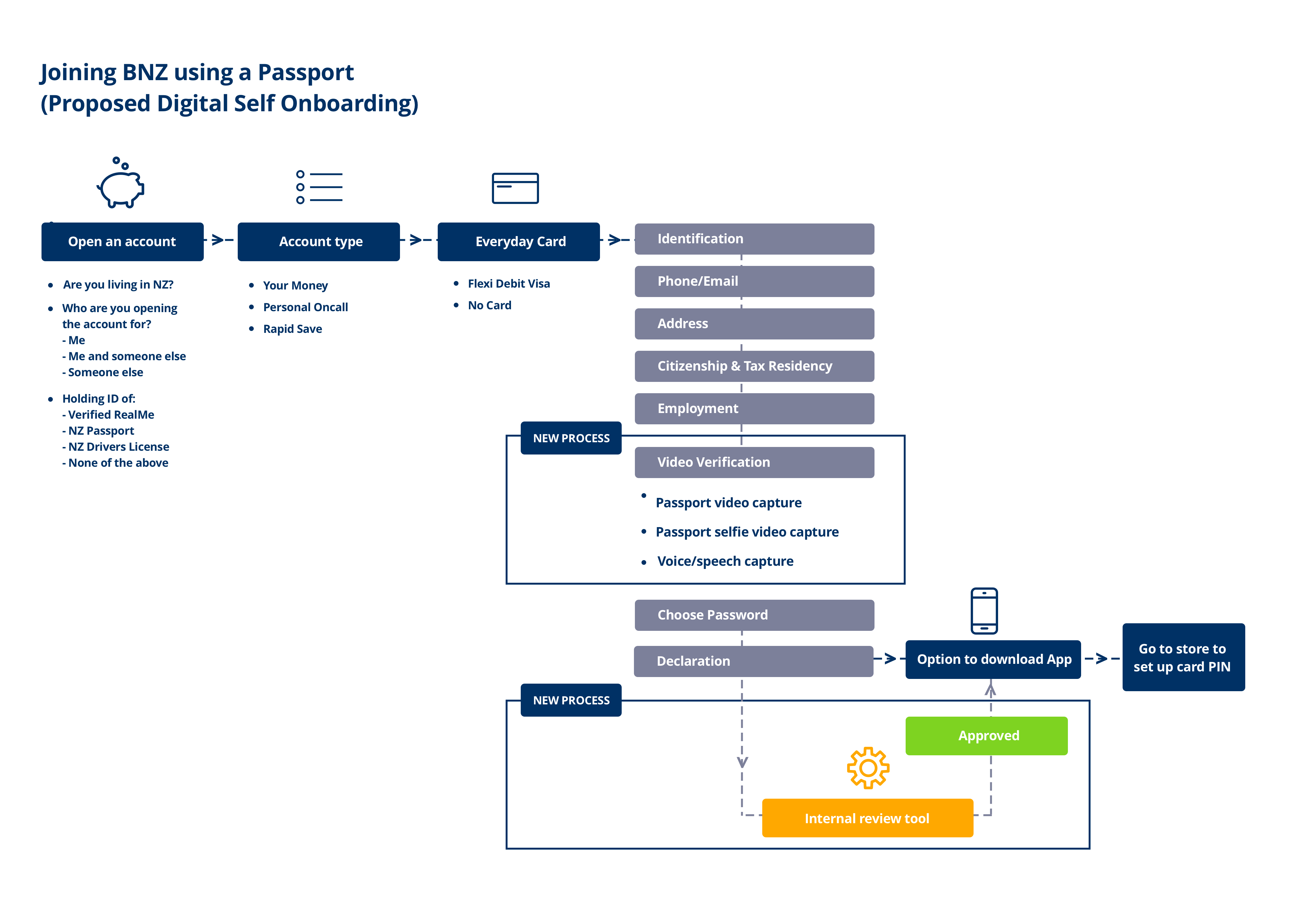

Prioritised Idea

Anywhere Sign-up

08.-

Testing

Usability Testing

I partnered with our user research team to run multiple 15min guerrilla testing sessions in Wellington. The aim of these testing sessions were to see if people could:

• Correctly take a selfie with their identification

• Correctly capture a photo of their identification

• Correctly repeat back phrases to prove their identity

08.-

Outcomes

Outcomes

As a result, we were able to refine the UI and UX to reduce errors, allow for clearer messaging, and allow customers to sign up faster.

This service went live in October 2018. Click here for the news report.